are hoa fees tax deductible for home office

Per the IRSs Internal Revenue Code. However you might not be able to deduct an HOA fee that covers a special assessment for improvements.

An Easy Guide To The Home Office Deduction

You cant deduct your mortgage payments.

. 47601 and LAC 61I308A2 and the HOA is required to file a Form CIFT-620. If say you have 12000 in income 10000 in expenses and a 3000 in home-office expenses you carry 1000 of the home office bills forward to. Generally your home office must be either the principal location of your business or a place where you regularly meet with customers or clients and you usually.

Its important that the space not be used for anything else. This new fee is in addition to any fees previously permitted by statute. Having a home office also allows you to deduct local transportation expenses.

Mortgage interest on rental property loans is unaffected by the TCJA. Are HOA Fees Tax-Deductible. Yes a HOA organized as a corporation is subject to the franchise tax even when is it a nonprofit pursuant to LA RS.

And if you use part of your home exclusively for business you can typically write off expenses related to the business use of your home. HOA Resale Inspection Fee Under this new bill an HOA is now authorized to charge a fee of up to 5000 to conduct an inspection in connection with the resale of a lot if the inspection is required by the HOAs governing documents. More than 50 of all businesses in the United States are now home-based.

HOA Short Term Rental. Without a home office a trip from your home to the business site will be considered a personal expense. Home mortgage interest remains deductible up to 1000000 for loans that settled before December 15 2017.

Contributions made to the following self-employed retirement plans are tax-deductible. Court fees and legal fees are deductible. Expenses paid by tenant.

Home mortgage debt incurred after December 15 2017 is only deductible up to 750000. EXHIBIT A - MORTGAGE LOAN SCHEDULE A-1 EXHIBIT B - LIMITED POWER OF ATTORNEY B-1 EXHIBIT C - FORM OF REQUEST FOR RELEASE C-1 This Servicing Agreement dated as of January 30 2001 the Agreement is among GMAC Mortgage Corporation as servicer the Servicer the GMACM Home Loan Trust 2001-HLTV1 as issuer the Issuer and The Bank of New York as. Legal fees are usually incurred as part of the costs of an eviction.

Top 9 Essential Items To Include In Your Condo Welcome Package May 27 2016. Renters and homeowners can take advantage of the home office deduction. With the home office the same trip will be considered a business expense.

Home Office and Office Supplies. If you have a dedicated space in your home for your real estate business you can deduct that portion of your home. Investors who belong to a Homeowners Association have to pay dues.

Business owners who live in a condominium or cooperative building or in an area with a neighborhood association might be eligible to deduct some of their homeowners association fees. Legal fees for an eviction. Since theyre a necessary expense that makes them deductible against rental income.

Rental property owners can deduct HOA fees that they are paying vs. As such its best to check your HOA Airbnb rules and local laws before listing your home on the app. These business insurance costs are tax-deductible.

Pay Dues Online 877 252-3327. All fees paid to your businesss accountant over the course of the year are fully tax deductible. HOA fees utilities.

Premiums for business insurance are a sizable overhead cost but luckily many qualify as a tax deduction. Key Takeaways You may qualify for the home office deduction if you use a portion of your house apartment condominium mobile home boat or similar structure for your business on a regular basis. Requirements and Best Practices for Home Offices.

Is a homeowners association HOA that is a nonprofit required to file a corporation franchise tax return with the State. Solo 401k For the 2021 tax year the maximum. If your property is used for rental purposes the IRS considers HOA fees tax deductible as a rental expense.

For rent you calculate the percentage of square footage of your. HOA fees are often used to pay for maintenance landscaping and general upkeep of the community and common areas. Tax Deductible Real Estate Expenses.

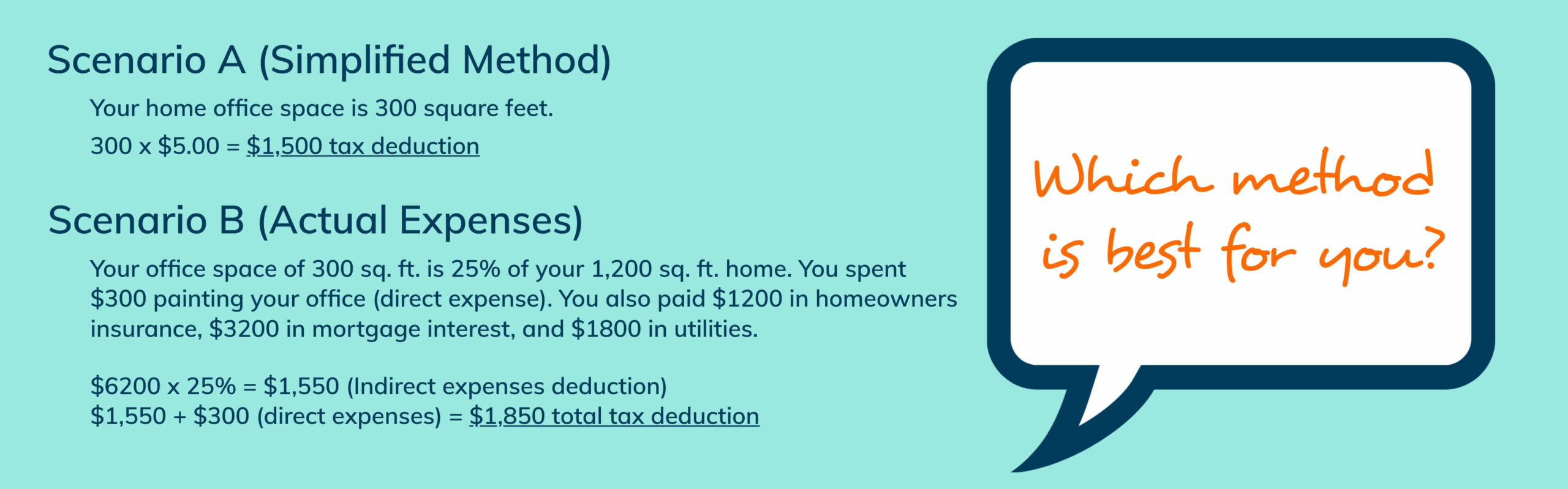

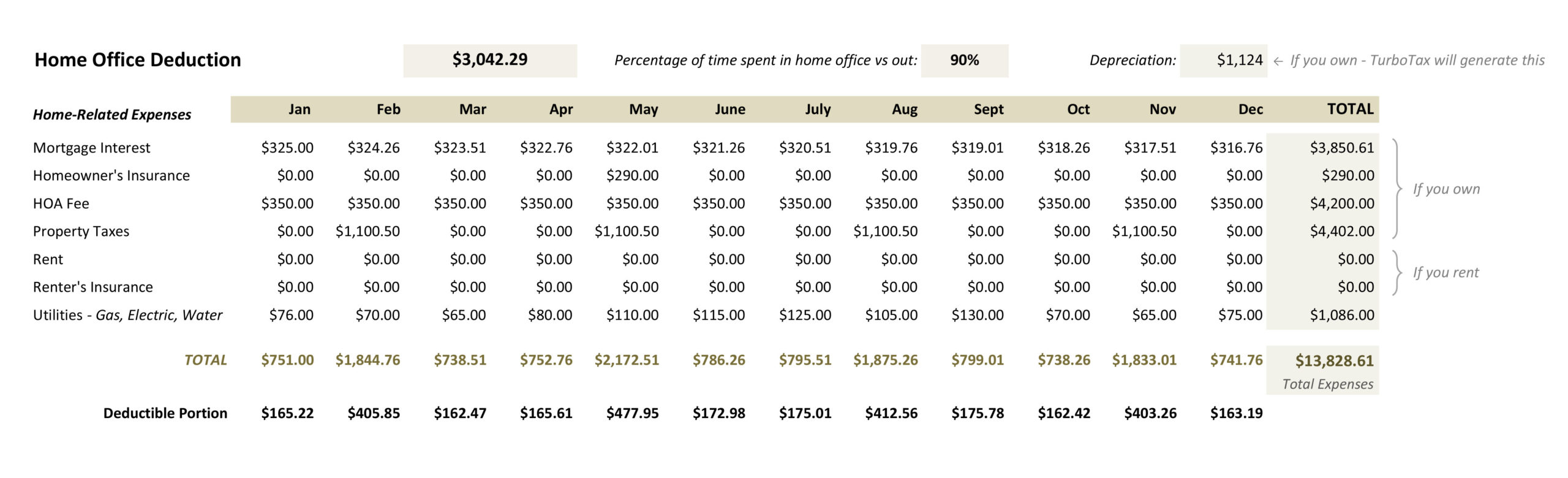

Mortgage interest and rent payments can be deducted but only the portion that applies to your home office. Even if you have a home office you cant deduct your homes rental expenses from your taxes. The IRS has a home office deduction worksheet that will help you calculate this scroll to the bottom of the document.

What Are Tax Deductions The Turbotax Blog

Tax Deductions For Home Office A Guide For Small Businesses

The Home Office Deduction Simplified Vs Actual Expense Method

Are Hoa Fees Tax Deductible The Handy Tax Guy

Are Hoa Fees Tax Deductible Here S What You Need To Know

Are Hoa Fees Tax Deductible Complete Guide Hvac Buzz

Can I Write Off Hoa Fees On My Taxes

Are Hoa Fees Tax Deductible Clark Simson Miller

Are Hoa Fees Tax Deductible The Handy Tax Guy

Calculating Your Home Office Expenses As A Tax Write Off Free Template Lin Pernille

Calculating Your Home Office Expenses As A Tax Write Off Free Template Lin Pernille

What Hoa Costs Are Tax Deductible Aps Management

Can You Claim Hoa Fees On Your Taxes

Are Hoa Fees Tax Deductible Clark Simson Miller

Form 8829 For The Home Office Deduction Credit Karma Tax

Are Hoa Fees Tax Deductible Experian